✖

Foreign Account Tax Compliance Act (FATCA)

ila Bank, its subsidiaries and its associates are compliant with the requirements of FATCA and CRS, where applicable.

Foreign Account Tax Compliance Act (FATCA) is United States (US) Tax Law aimed at curbing tax evasion by US citizens and residents through the use of offshore accounts maintained outside the United States. It requires Foreign (non-US) Financial Institutions (FFIs) to identify their US clients (both individual and entities) and report on their account information to the Internal Revenue Service (IRS).

Common Reporting Standard (CRS) is a commonly used term for Automatic Exchange of Information (AEOI) in Tax Matters. CRS is published by Organization for Economic Co-operation and Development (OECD) and supported by G20 countries. Article 6 of the Convention on Mutual Administrative Assistance in Tax Matters provides a legal framework for its implementation globally. The main objective of CRS is to improve tax transparency through information sharing about financial assets of tax residents of a country in other jurisdictions participating in the CRS program.

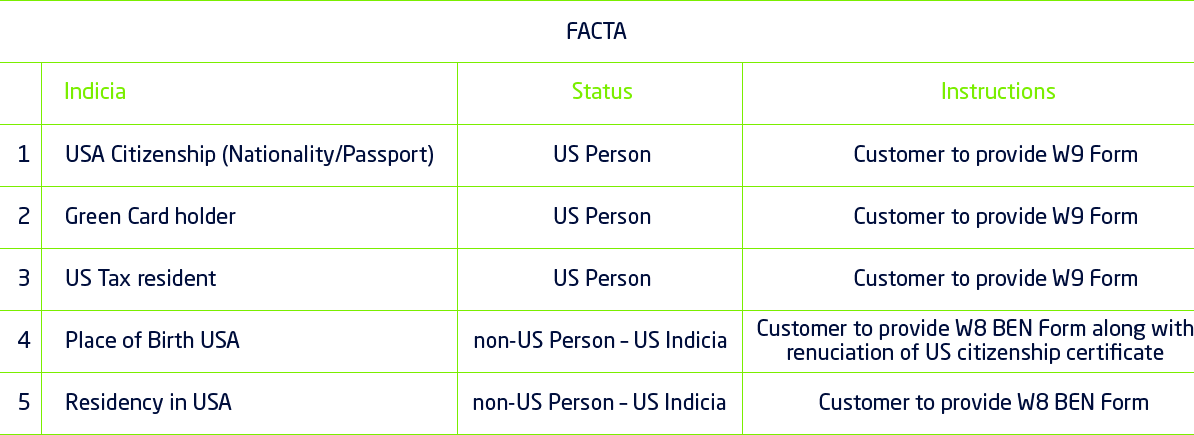

Required Documents for FATCA: